[dmg_masonry_gallery...

LASTING IMPACT

A BOOK BY

JUST IN TIME

100K COMMUNITY

STAFF

ANNUAL REPORT

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

FAQS

LASTING IMPACT

NEWLY PUBLISHED BOOK

100K COMMUNITY

STAFF

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

ANNUAL REPORT

FAQS

LASTING IMPACT

NEWLY PUBLISHED BOOK

100K COMMUNITY

STAFF

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

ANNUAL REPORT

FAQS

[dmg_masonry_gallery...

[dmg_masonry_gallery...

[dmg_masonry_gallery...

We're excited to meet you! More than half our staff are former foster youth, many of us have participated in JIT’s services. We understand first-hand the challenges that each of us face on our path to self-sufficiency. And we are proof that having essential resources and consistent relationships with caring adults can have a lasting positive impact. Reliable, Responsive Real– JIT peers, coaches and staff share a common commitment to empowering you. Welcome to YOUR new community.

Michael loves people and networking, so when Pathways to Financial Power appeared on his radar, he was excited to join. “I’m a business and accounting major, so I know the math side, but Pathways...

YOUTH STORIES

Entering foster care at the age of twelve, Ana experienced seven different placements in three years. “I always remember sitting in foster homes thinking, ‘When I get out of here and have control...

In 2022, when Kory left Pittsburgh for San Diego, he was leaving behind more than his hometown; he was leaving behind a dark period of uncertainty and betting on a better life. Having survived...

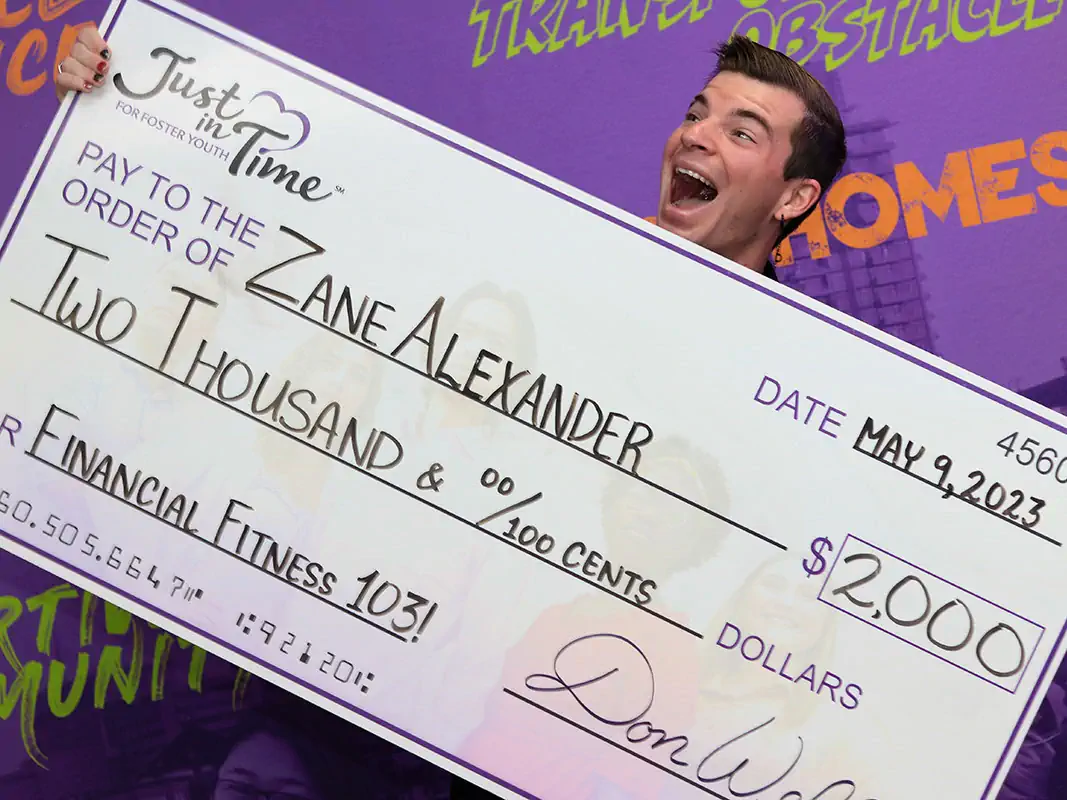

When Monique joined Financial Fitness, she knew her relationship with money “wasn’t great.” Her bank account reflected this - bouncing up and down with her mood swings. “If I had a lump sum of cash...

The most common form of legacy gift is a bequest from a Will or Trust. A bequest is a section of your will or living trust that directs a gift from your estate to the person or institution of your choice.

Sample language to add a bequest to a Will or Trust:

General Bequest: “I give to Just in Time for Foster Youth, a California nonprofit corporation, Tax ID #20-5448416, <the sum of $____________> to be used in furtherance of its exempt charitable purposes.”

Residual or Proportional Bequest: Substitute “<xx percent> or <all of the residue of my estate.>”

Bequest of Property: Substitute “<all of my interest in the following described property ______________________________________>”

Click here to download a complimentary Estate Planning Guide.

When Don Patterson first read an article about Just in Time for Foster Youth, he knew right away that this mission spoke to his heart.

He, too, had spent time in foster care as a child and, even after a 30-year thriving career as a faculty member at Grossmont College, he still remembered vividly the challenges of growing up apart from one’s family.

When Don met JIT staff member, Virgo, for coffee, he frequently expressed gratitude for the work we do for our “foster brothers and sisters.” When Don visited our JIT headquarters, he was surprised and pleased that we made the effort to decorate our space like we would a home – with photos of our JIT family, inspirational sayings, a welcoming kitchen, and comfy spots to hang out and reflect.

As his partner, Enrique tells us, “Don always believed that any youth should have the opportunity to develop his/her potential in this life. He was an excellent role model and succeeded in education and the arts.”

Don always sent his annual check to Just in Time at the end of the year once he figured out how

much was in his savings. But Don also gave careful thought to his legacy, and he created an estate plan with JIT as one of his beneficiaries. We were very saddened to hear about Don’s sudden passing as he was a special man and a good friend to JIT. We’ll be forever grateful for his commitment to helping other foster youth succeed, both during and beyond his lifetime

Known as the Qualified Charitable Distribution (QCD) or Charitable IRA Rollover, gifts to Just in Time made directly from an Individual Retirement Account are a win-win-win!

Click here to download an easy QCD request form to share with your Financial Advisor or Retirement Plan Custodian/Administrator

If you own real estate, consider gifting it to Just in Time when you no longer need it. In addition to avoiding the hassle of a sale, gifting real estate such as your residence or rental property may provide significant tax and other benefits.

There are multiple ways to invest in the futures of young people leaving the foster care system with a gift of real estate:

Charitable Remainder Trusts, Charitable Annuity Trusts, and Charitable Gift Annuities each allow donors to make a gift of cash or appreciated property in exchange for payments for their lifetime or a term of years.

Click here to download a complimentary Estate Planning Guide.

This information is intended to be educational in nature and does not serve as professional tax, legal, or accounting advice. For specific advice about any of these concepts, please consult your qualified professional advisor(s).