[dmg_masonry_gallery...

LASTING IMPACT

A BOOK BY

JUST IN TIME

100K COMMUNITY

STAFF

ANNUAL REPORT

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

FAQS

LASTING IMPACT

NEWLY PUBLISHED BOOK

100K COMMUNITY

STAFF

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

ANNUAL REPORT

FAQS

LASTING IMPACT

NEWLY PUBLISHED BOOK

100K COMMUNITY

STAFF

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

ANNUAL REPORT

FAQS

[dmg_masonry_gallery...

[dmg_masonry_gallery...

[dmg_masonry_gallery...

We're excited to meet you! More than half our staff are former foster youth, many of us have participated in JIT’s services. We understand first-hand the challenges that each of us face on our path to self-sufficiency. And we are proof that having essential resources and consistent relationships with caring adults can have a lasting positive impact. Reliable, Responsive Real– JIT peers, coaches and staff share a common commitment to empowering you. Welcome to YOUR new community.

Michael loves people and networking, so when Pathways to Financial Power appeared on his radar, he was excited to join. “I’m a business and accounting major, so I know the math side, but Pathways...

YOUTH STORIES

Entering foster care at the age of twelve, Ana experienced seven different placements in three years. “I always remember sitting in foster homes thinking, ‘When I get out of here and have control...

In 2022, when Kory left Pittsburgh for San Diego, he was leaving behind more than his hometown; he was leaving behind a dark period of uncertainty and betting on a better life. Having survived...

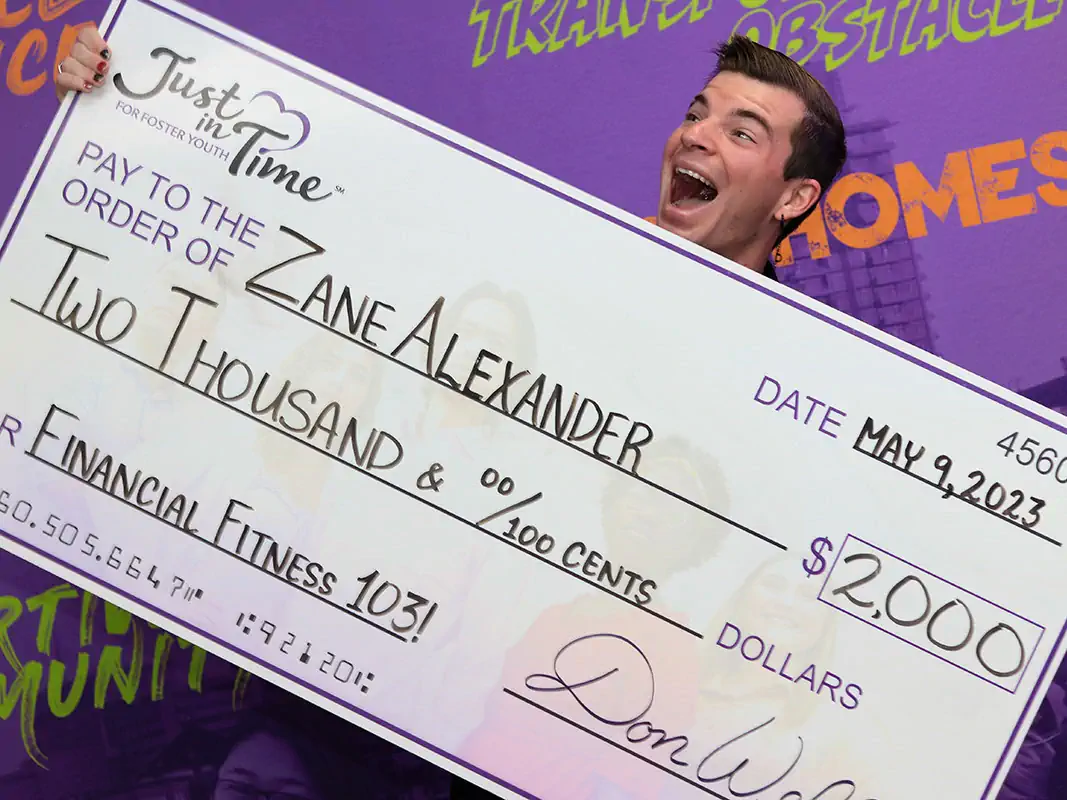

When Monique joined Financial Fitness, she knew her relationship with money “wasn’t great.” Her bank account reflected this - bouncing up and down with her mood swings. “If I had a lump sum of cash...

Stock Transfers and RMDs: Making a gift of stock or choosing JIT as the beneficiary of an RMD are simple yet powerful ways to create lasting impact in the lives of transition age foster youth in San Diego County.

Tax ID #20-5448416

Please contact Chris Turner at 619-269-5422 for instructions.

Mail your UNENDORSED certificate(s) with a Stock Power Form and a Stock Waiver Form by registered mail to:

Just in Time for Foster Youth

Attn: Don Wells, Executive Director

PO Box : 601627

San Diego, CA 92160

E-mail: don@jitfosteryouth.org

Phone: 858-663-2081

Fax: 619-677-2113

NOTE: Certificates already registered in the name of Just In Time for Foster Youth do not require either the stock waiver or stock power for execution of the transfer. Please email to don@jitfosteryouth.org or mail the following information to Just In Time:

If you are over age 72, you may give a gift from your IRA as a tax-free distribution to Just in Time for Foster Youth (JIT). This means an amount (up to $100,000 annually) transferred from your IRA directly to JIT can count toward your required minimum distribution without being considered taxable income for you. The distribution, also known as an IRA Charitable Rollover, is authorized by Section 408(d)(8) of the Internal Revenue Code. As always, please consult your advisor to determine if this type of gift is right for you.

A donation transferred directly from your IRA to Just in Time for Foster Youth is not considered taxable income on your federal income tax return, but it does count toward your required minimum distribution as long as the donation is received by December 31.

Click here to view a list of frequently asked questions about IRA Qualified Charitable Distributions.