[dmg_masonry_gallery...

LASTING IMPACT

A BOOK BY

JUST IN TIME

100K COMMUNITY

STAFF

ANNUAL REPORT

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

FAQS

LASTING IMPACT

NEWLY PUBLISHED BOOK

100K COMMUNITY

STAFF

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

ANNUAL REPORT

FAQS

LASTING IMPACT

NEWLY PUBLISHED BOOK

100K COMMUNITY

STAFF

BOARD OF DIRECTORS

INVESTORS & SPONSORS

COMMUNITY COLLABORATIONS

FINANCIALS

ANNUAL REPORT

FAQS

[dmg_masonry_gallery...

[dmg_masonry_gallery...

[dmg_masonry_gallery...

We're excited to meet you! More than half our staff are former foster youth, many of us have participated in JIT’s services. We understand first-hand the challenges that each of us face on our path to self-sufficiency. And we are proof that having essential resources and consistent relationships with caring adults can have a lasting positive impact. Reliable, Responsive Real– JIT peers, coaches and staff share a common commitment to empowering you. Welcome to YOUR new community.

Michael loves people and networking, so when Pathways to Financial Power appeared on his radar, he was excited to join. “I’m a business and accounting major, so I know the math side, but Pathways...

YOUTH STORIES

Entering foster care at the age of twelve, Ana experienced seven different placements in three years. “I always remember sitting in foster homes thinking, ‘When I get out of here and have control...

In 2022, when Kory left Pittsburgh for San Diego, he was leaving behind more than his hometown; he was leaving behind a dark period of uncertainty and betting on a better life. Having survived...

When Monique joined Financial Fitness, she knew her relationship with money “wasn’t great.” Her bank account reflected this - bouncing up and down with her mood swings. “If I had a lump sum of cash...

To plan for your secure financial future you need the confidence and know-how to practice smart money management. That’s why in our Financial Fitness series, our lived experience staff share their first-hand knowledge about budgeting, smart saving habits and investment strategies. You’ll also be paired with a coach to support you on your journey to financial self-sufficiency.

Financial Fitness 101 empowers transition age foster youth to begin the journey from surviving to thriving through learning foundational financial literacy concepts to establish healthy money habits.

We understand that you are working hard to become financially independent to meet your needs and overcome moments of crisis. Financial Fitness 101 was created to support you in creating new healthy financial habits through a self-paced online curriculum.

Financial Fitness 101 participants will:

To join Financial Fitness 101, you must:

Demonstrate productivity such as working and/or going to school, OR actively making strides toward doing so

Meet and communicate regularly with a paired financial coach and our JIT Financial Fitness Coordinator

Commit to saving on a monthly basis

Financial Fitness 101 is available throughout the year and is open to all Just in Time participants. If you are interested, you are welcome to reach out to us at any time!

Apply for Financial Fitness 101 in the JIT Application Hub here.

Financial Fitness 102 provides participants opportunities to further develop core financial literacy concepts while making progress towards financial security/stability by establishing a rainy day fund.

Financial Fitness 102 is Just in Time’s intermediate financial literacy service delivered as an eight-week group workshop learning experience with individual weekly assignments. In FF 102, participants explore their values, goals, and relevant external influences and develop the core financial capability concepts of earning, spending, saving, investing, borrowing, and protecting their money. As participants add to their savings account, Just in Time will contribute a matched portion to achieve a meaningful rainy day fund. Financial Fitness 102 Coaches attend workshops and individual meetings with participants to develop long lasting, meaningful relationships to facilitate a lifetime of financial wellbeing.

To join Financial Fitness 102, you must:

Six-week Financial Fitness 102 cohorts occur throughout the year and are open to all JIT youth.

Apply for Financial Fitness 102 in the JIT Application Hub here.

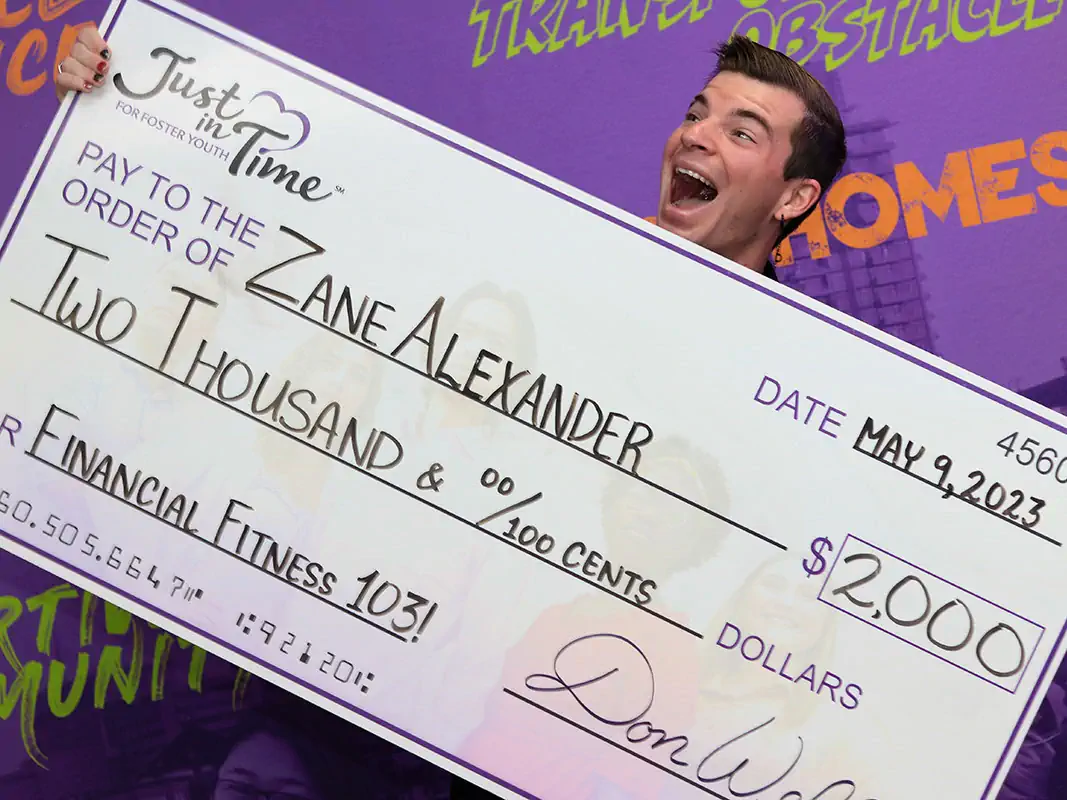

Financial Fitness 103 offers transition age foster youth opportunities to learn more advanced financial knowledge and skills while focusing on long term investing.

Financial Fitness 103 offers monthly workshops on financial topics such as investing, retirement planning, loans, taxes, home ownership, entrepreneurship, and much more. The intention of Financial Fitness 103 is to have participants become knowledgeable investors by learning how to create a diversified, low cost investment portfolio that reflect the participants individual goals, risk tolerance, and time horizon. Each participant is paired with an advisor who will coach and guide them throughout the duration of the service. Additionally, eligible participants can receive matched savings of up to $4,500 for their investment accounts!

To join Financial Fitness 103, you must:

Financial Fitness 103 is an ongoing service which youth are invited to join at any time throughout the year.

Apply for Financial Fitness 103 in the JIT Application Hub here.

Click here to access our Savings Match form.